Fix The Regulators

In February 2023 we published “Fix The Regulators”, our argument that we need to radically rethink how we regulate innovation. We launched FTR at an event with Lord Johnson, Minister for Investment and Regulatory Reform in the British government, and >75 investors, founders and policymakers.

Executive summary

Creaking regulatory capacity is constraining economic and startup growth, slowing innovation in the sectors that matter most to people’s lives, and becoming a rate limiter on UK startup and tech progress.

Startups and investors have long campaigned for better capital and talent policy to support the tech ecosystem. But a further category has been neglected: regulatory agility. Regulators stand between an ever-growing number of UK startups and their customers, and for many this is now their biggest barrier to growth and commercialisation.

Now, we need to massively reset our ambition. The UK should aim for new products to be licensed more quickly than anywhere in the world, with agile permissions that pivot in line with the product. We can massively reduce friction for founders, without lowering standards for customers.

Fixing this does not require major investment or legislation, but would have an enormous impact on crowding in private investment, helping companies to scale, and underpinning economic growth. It is time to take that opportunity seriously.

1. The UK should set an ambition to have the fastest regulatory approval timelines in the world

Introduce a ‘pay for speed’ option, including for regulators that are not usually funded by industry and where application fees are usually free, to secure a speedy decision with guaranteed fee refunds where an ambitious timeline is not met. (This is risk-free: either it improves speed and allows for investment in capacity, or applicants revert to standard pricing, but it should not lead to higher prices for the same or worse outcomes.)

Expand international recognition procedures where novel and frontier technologies have already been internationally authorised in other trusted jurisdictions (such as the US, Europe, and Singapore), reducing domestic regulatory burden and expediting approvals for domestic products, devices and services

2. Put innovation at the heart of regulatory policy in government by creating a new Regulatory Innovation Unit and reinforcing other existing institutions

Establish a joint No 10-Cabinet Office-DSIT unit to drive regulatory innovation across government by:

Surfacing, triaging and prioritising legislative change requests from regulators.

Keeping a public register of strategic steers requested by regulators

Requiring departments to explain why pro-innovation changes have not been taken forward

Monitoring regulatory performance, with the NAO and ONS, to explicitly encourage regulatory innovation by tracking approval backlogs and regulatory budgets over time, building comparable performance indicators, and estimating the cost of delayed and foregone innovation

Exploring how this unit could become a radically new, cross-sectoral innovation regulator, as a long-term solution for frontier, disruptive innovations test the limits of legacy, sectoral regulator structures

Beef up the Regulatory Horizons Council, by:

requiring that government responds to RHC reports within 1 month

aligning funding decisions from the Regulatory Pioneers Fund with RHC advice, to accelerate implementation of its recommendations

creating an RHC-investor panel, as recommended in the RHC’s own Closing the Gap report, to ensure RHC activity is continually based on insight and feedback from the technology frontier

Expand the Digital Regulation Cooperation Forum (DRCF), which only includes 4 regulators, into a wider, Technology Regulation Cooperation Forum (TRCF). This should incorporate other regulators at the frontier of AI and technology, such as the MHRA, CAA and VCA, and report into the new Regulatory Innovation Unit.

3. Fund sectoral regulators to upgrade capability

For regulators financed at least in-part by the government, the Treasury should permanently uplift funding to restore their 2021 budgets in real terms to recoup core, ‘business as usual’ capacity, and also commit to annual, inflation-linked budget increases to accelerate new efforts. Both could be funded via the government’s £15bn R&D budget.

Expand the Regulatory Pioneers Fund to £50m initially, in time rising to £100m+, to provide dedicated surge capacity for regulatory innovation projects on top of core funding increases.

4. Reset regulatory risk appetite in favour of innovation

Departmental Ministers should issue a strategic steer to their sponsored regulators, committing to the view that short-term conservatism ultimately leaves consumers worse off. This should provide the political cover necessary to improve competition and unlock the innovation necessary for improved outcomes

Why this matters

Fixing the UK’s regulators is essential to unlocking innovation in the sectors that most affect people’s lives, crowding in private investment, and securing future growth and industries in the UK.

Startups are increasingly coming to the fore as engines of progress, proving how small, tightly coordinated teams can have an outsized impact on the world. Indeed, most of the UK’s startup successes today have been in regulated markets like fintech, healthcare, energy and transport. These are ‘markets that matter’, where policymakers and founders can partner in the public interest. And now, the next generation are both innovating in traditional regulated markets and creating entirely new industries that could transform our lives, such as AI, cell-cultivated food, and carbon markets.

Startups are not arms of the state, ****but unlocking their breakthrough potential must be a priority for any government. Progress in AI, bio, food, health, finance, transport and many other sectors is core to the UK’s economic growth. It’s also critical that the UK has a stake in the future of these globally important sectors. Agile, effective regulators are critical to this: while UK regulators are creaking, Singapore and the US are already tempting UK companies in sectors like alternative proteins to relocate, not least because they have moved more quickly to regulate and provide innovators with an efficient, quality authorisation service.

Although the UK cannot and should not always compete on market size or government subsidies, we can become the best place for startups to design, test and bring products to market, in partnership with regulators. Post-Brexit, the UK has no excuse but to build this regulatory advantage: and critically this is not purely about deregulation, but about improving speed and agility independently of any specific rule changes or thresholds. We can be ambitious and impatient about this necessary structural reform, without lowering standards.

Getting this right would then crowd in private investment. As the Harrington Review on Foreign Direct Investment set out:

“the UK needs to recognise the importance of its regulators as engines of growth post-Brexit, and resource them accordingly as investments for future returns. Investing in regulators, when added to clear direction, consistency and accountability, is likely to be a highly effective use of public resources to attract investment.” Lord Harrington, The Harrington Review of Foreign Direct Investment

For all the hand-wringing about industrial strategy and our response to the US Inflation Reduction Act, it is regulatory agility and ambition that can make the biggest difference to our economic outlook.

Finally, weak regulatory capacity is quickly becoming a major constraint on broader science, technology and competition policy. For all the merited focus on ‘inputs’ to UK innovation and international competitiveness – capital, visas, spinouts, etc. – these levers are increasingly blunted by regulatory bottlenecks and backlogs, artificially limiting the potential of this support. While entrepreneurs in the ‘markets that matter’ are holding up their end of the bargain, regulators are increasingly unable to move as quickly as the public interest demands – entrenching incumbents who feel little pressure to deliver better for consumers.

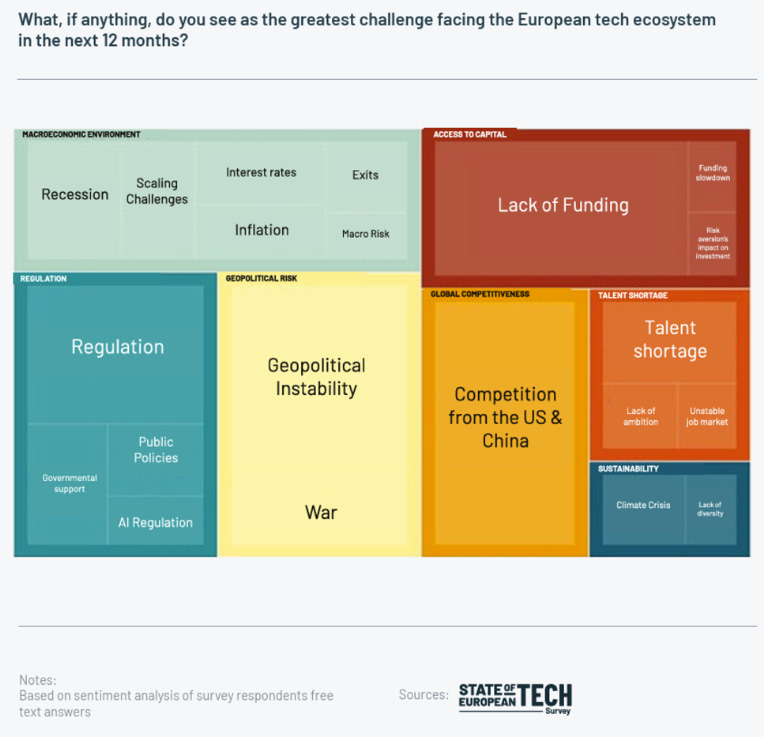

Startups cite regulation as a key concern, State of European Tech 2023, Atomico

The three big issues

Fixing our regulators and empowering startups means tackling three issues that hold regulators back:

Resource: investing in regulatory capacity to understand and approve new technology

Rule changes: creating flex where novel tech is constrained by legacy laws and regulations

Risk appetite: giving regulators the incentive and political cover to take measured risks

Issue 1: Resource

UK regulatory speed is now creaking under the weight of two generational challenges:

Post-Brexit, UK regulators have had to take on many new responsibilities. When demand for the ‘day job’ grows, this squeezes out space for enabling innovation.

Frontier, accelerating technologies, such as AI or cell-cultivated food, have massively increased the learning curve required of regulators.

But resource has not increased commensurately: in 2021, the MHRA, after hiring 7.5% additional staff post-Brexit, then faced having to make up to 25% of its staff redundant; Ofgem staff were forced to reapply for their jobs during the energy crisis; and the Food Standards Agency (FSA) has had its budget frozen for 3 years until 2025, in effect facing a £30-40m real terms cut. Emily Miles, CEO of the FSA, has commented that:

"We really want to be able to respond to innovative and emerging food technologies but our current resource constraints and the legal strictures of the current regimes mean we can’t do as much as we’d like." Emily Miles, CEO, Food Standards Agency

These resource constraints are particularly pronounced when hiring for staff with experience of frontier technologies. Although regulators often have more flexible pay bands compared to the civil service, they are still limited. And necessarily, the talent pool of people who understand frontier technologies is small, and even smaller for those who want to work for a regulator. Some large regulators might succeed – when Ofcom was given powers over online safety, they could hire from a growing Trust & Safety industry – but others which are smaller but no less critical may find recruitment much harder. This includes authorities like the Vehicle Certification Agency, which will be the responsible authority for autonomous vehicles.

In contrast, there are demonstrable benefits when institutional capacity is prioritised. Akin to ARIA, the AI Safety Institute (/Frontier AI Taskforce) was well-resourced from Day 1 (£100m) taking the resource question off the table. It also recruited senior leaders from the tech sector to drive work forward quickly. Combined, this effort established the UK as a leading voice in AI Safety while also accelerating the clarity necessary for AI companies to grow.

More recently, the government has committed £10m to upgrade AI regulatory capacity, recognising that resource is becoming an issue for both companies and authorities alike. But this is a rounding error in government spending on science and technology. £10m is the same amount received by the MHRA in the Spring 2023 budget: although senior industry figures state that this ‘does not touch the sides’ of the MHRA’s resource challenges, it has nevertheless made solid progress in clearing a backlog of clinical trials, accelerating its Software and AI medical device guidance in partnership with the FDA and Health Canada, confirming a new AI sandbox specifically for medical devices and **finally launching the Innovative Devices Access Pathway pilot. In contrast, £10m to upgrade capacity at all AI regulators is clearly sub-scale.

Relative to the c£15 billion spent annually by government on upstream R&D, science and technology, the budget for downstream regulators to help get these innovations to market is minimal. The Regulatory Pioneers Fund (RPF) – which funds individual projects by regulators to support business innovation – is a meagre £12m. After three rounds of funding since 2021, its future is unsecure, despite officials across Whitehall recommending its expansion. This isn’t nearly sufficient to accelerate a backlog of regulatory innovation projects, and does little to plug wider resource gaps. However, given regulatory funding is fragmented between different sponsoring departments, the RPF is also one of the few cross-departmental funding levers available to fix a regulatory capacity gap that has now become cross-sectoral. It should be scaled up significantly, at minimum to £50m and in time rising to £100m+.

A further solution could be to allow more regulators to raise their own revenues, as recommended by the Lords Committee on Industry & Regulators. The Vehicle Certification Agency and NICE Advice are just some of the authorities that have powers to generate income via technical advisory services to industry, and this model could be expanded subject to strict firewalls between this advice and core authorisation processes. Other regulators’ core funding already comes from charges and levies on industry, such as application fees, which provides a mechanism to scale resources in proportion with growing demand. But companies cannot be left paying higher costs for equivalent, or worsening, services. Instead, borrowing from proposals to the planning system, regulators should provide a ‘pay for speed’ option where a higher fee guarantees a quicker service: companies that value an accelerated approvals option could pay for it, but they’re refunded if the guarantee is not met.

The regulatory funding gap is neglected in policy debates about UK science & technology, but entirely solvable. And while there are other constraints on regulatory speed and capacity, lack of resource must at minimum be taken off the table as a blocker.

Issue 2: Rule changes

Other regulators are constrained by the rules they operate within, even if they have the resources and risk appetite to drive innovation.

Until the Automated Vehicles Bill 2023 was introduced to Parliament, the vehicle safety regulator, the Vehicle Certification Agency, could not push on with approving a broad range of autonomous vehicles. In 2022, a Transport Bill was proposed, which would have legalised autonomous vehicles in the UK, but it was then pulled. Only once manufacturers, developers and insurers had comprehensive legislation, rather than piecemeal promises, did they have confidence that autonomous vehicles could be brought to market at scale with a trusted liability framework. In turn, this accelerates regulator expertise which in turn drives industry confidence and investment, deepening the UK’s competitive advantage – akin to Singapore’s approach to cell-cultivated foods.

Similarly, in the food sector, a genuine benefit of Brexit regulatory freedoms was the ability for the UK to permit gene editing in plants and animals – a step which the EU is now also moving towards. The Precision Breeding (Genetic Technologies) Act 2023 may prove to be an excellent source of competitive advantage, with food technology companies getting started or accelerating their efforts in the UK due to this legislative momentum. But now it falls to the Food Standards Agency to actually design and implement the new regulatory regimes created by the Act, and this has been slow going due to limited resource, despite their ambition. It also has plans to reform EU-inherited rules around 'novel foods' and the application process, but again struggles to do so quickly due to resource constraints.

Finally, the Human Fertilisation & Embryology Authority (HFEA) is now explicitly asking for changes to the HFE Act 1990 to give them “greater discretion to support innovation in [fertility] treatment and research”.

All three examples highlight how, where deregulation or new rules are required to keep pace with technology, this too requires investment: both of scarce ministerial and parliamentary time, and of regulatory capacity to establish new systems once the law changes. Yet although regulators are the first to see where existing rules prevent them approving new innovation, this insight often remains buried within government for months or years.

The Department for Business and Trade’s exploration of ‘international fast track’ pathways and targets for regulatory approvals – combined with a ‘productivity lock’ to continually ratchet up targets – is welcome. This could accelerate approvals for all of the sectors highlighted here, as well as others such as nuclear: recognising reactor designs such as South Korea’s KEPCO APR-1400, a tried-and-tested approach which was approved by the US in 2019, could reduce the cost of new nuclear plants by up to 5x.

These mutual recognition procedures should be expanded where it can clearly unlock innovation. Where trusted jurisdictions such as the US, Europe and Singapore have already approved novel and frontier technologies, the UK should implement a ‘mutual recognition ratchet’ to expedite UK approvals and reduce burden on domestic regulators.

Issue 3: Risk appetite

Some regulators have both the resource and legislative flexibility to enable innovation, but lack the risk appetite, ambition and incentives to do so. Regulators prioritise their duty to protect consumers over any other considerations, such as competition, innovation, or growth. The rationale for this is understandable: the Civil Aviation Authority’s main concern is ensuring aviation safety, while the Financial Conduct Authority reasonably wants to prevent harms to consumers. Resource constraints also compound this nervousness: if decisionmakers have limited expertise and even less time to acquire it, delay and denial of authorisation is the path of least resistance.

What is missing is an understanding that this focus on safety and market stability comes at a price. Not only does it restrict the UK’s ability to build the next generation of globally-significant companies, but it also downplays the long term benefits that competition and innovation generate for consumers. Dominant players that operate free from competition have little incentive to improve outcomes for consumers, while regulatory bottlenecks also slow transformational innovation, which primarily comes from startups, not legacy incumbents. Medicine deliveries-by-drone, manufacturing in space, real-time credit bureaus, autonomous vehicles and many more products in both frontier and traditional regulated markets take far longer to come to market than they should, with society bearing the hidden cost of these foregone benefits.

Avoiding the “stability of the graveyard”

In this context, the government’s commitment to extending the Growth Duty to Ofcom, Ofwat and Ofgem is positive – in the sense that it may encourage these regulators to consider growth impact in its decisions, having not done so explicitly before – but in practice may simply lead to regulators ‘rebadging’ existing work as contributing to these new duties. The net effect is little change in behaviour, and further administrative burden on regulators.

The FCA argues its stronger approach to new authorisations is important for deterring consumer harms, but the methodology behind the analysis they commissioned to support this stance reveals precisely its lack of interest in innovation. No potential consumer benefits from authorising new firms are considered at all, so nothing is compared against the estimated value of ‘deterred harms’– while several assumptions are also made that seriously risk over-stating the value of ‘prevented harm’. This logic results in the creation of what former Chancellor George Osborne called “the stability of the graveyard”.

This defensiveness represents an extraordinary change in the FCA’s regulatory culture since 2016, when regulators, industry & government came together to make the UK 'fintech capital of the world'. This compact worked, delivering a group of globally-leading companies and putting the UK second only to the US in terms of the vibrancy of its startup ecosystem. Yet ten years on, this spirit of innovation and regulatory capacity has stalled.

In nominal terms, at least, the FCA has a reasonably large budget. While it has certainly had resource challenges, it is at least reasonable for policymakers to question the value the FCA is getting from its budget before raising industry fees (though this option should be kept in reserve).

Resetting risk appetites

Instead, regulators in this ‘low ambition’ category need political instruction and cover to prioritise innovation and take risks. Even the FCA is now calling for “a wider debate between policymakers, industry and consumers … about what we are willing to risk in search of innovation and better products and services”.

One way forward is for Ministers to systematically use periodic steers more frequently. Recent letters from departmental Secretaries of State focused on AI are a good start, but AI is not the only relevant technology at risk of being held back by regulators and one-off letter writing is not an adequate regulatory strategy.

To empower leaders to identify and challenge risk aversion, we also need timely, quality performance data for different sectoral authorities. But this is often either hard to find, lacking altogether, or hard to compare between regulators. At minimum, the ONS and NAO, together with regulators, should therefore collect, analyse and audit the following data:

A time series dataset of all regulators’ annual budgets, including tracking the share of funding that comes from industry fees vs government grants, as well as staff numbers and turnover

The NAO occasionally produces a ‘Departmental Overview’ of major regulators, but this is irregular and only covers major regulators. Instead, more timely and comprehensive data would cover every regulator, including smaller regulators responsible who still have major responsibilities for enabling frontier innovation, e.g. the Civil Aviation Authority and Vehicle Certification Agency.

A time series dataset of regulatory performance and backlogs, including:

Authorisation timescales for different permissions, demarcated into different types of applicants, e.g. for the FCA: new licence permission/senior manager/investor vs bank/consumer credit/insurance applicants

Authorisation rates: existing KPIs such as ‘approval rate within 12 months' are easy to game, since it’s not always clear when the regulator deems an application ‘complete’ – especially when there is protracted back and forth – so it’s easy to ‘start the clock’ late in the process.

International comparison of regulator budgets: e.g. MHRA and FSA budgets in 2021 totalled roughly £300m, compared to the US Food & Drug Administration’s budget of $7.2bn. Even on a ‘share of GDP’ basis, and accounting for the US’s different healthcare structure, there is an enormous gap.

Collecting this data would also empower policymakers, the NAO and regulators themselves to conduct better ‘innovation tests’ that estimate the costs of historical ‘foregone innovation’, and thus incentivise faster and more permissive approvals regimes going forward. This would plug a gap in regulator analysis equivalent to the CMA’s counterfactual analysis conducted during merger control investigations, or the Better Regulation Executive’s ‘Equivalised Annual Net Direct Cost to Business’ (EANDCB) metric.

Notably, from the limited data that is available, it is possible to see a rough correlation between regulators funded at least in part by government and those where funding is the issue (e.g. Food Standards, MHRA, and the Environment Agency), compared with those funded by industry where a lack of risk appetite is the issue (e.g. FCA, Ofwat, Ofgem).

Table: 2020-21 Budgets of major regulators, sorted by % share of funding from government (source: NAO Departmental Overview 2020-21: Regulation report)

New levers and institutions

Although regulatory reform is a perennial policy issue, too often it is tackled through distracting ‘red tape challenges’ or ‘one in, one out’ deregulatory mantras. Instead the focus should be about building a continuous, durable capability to understand the frontier of innovation, identify appropriate regulatory reforms, and deliver them as quickly as possible.

To that end, the Regulatory Horizons Council (RHC) produces excellent, expert work, but it has few levers to ensure its recommendations are taken forward. This means its work can often be overtaken by other issues that may be more urgent, but no more important. Instead, reports should get a response from the government within 1 month, not merely 3-6 months as the government committed to in its response to the Vallance/McClean Pro-Innovation Regulation of Technologies Review. The RHC should also be able to fund the next phase of work to accelerate progress, such as via control of the Regulatory Pioneers Fund. We would also endorse integrating the RHC and RPF into the new Regulatory Innovation unit.

Additionally, the Digital Regulation Cooperation Forum – a dedicated effort to share insight and resources between ‘digital’ regulators – should be expanded into a broader Technology Regulation Cooperation Forum (TRCF). Currently, the DRCF membership only includes Ofcom, the CMA, the FCA and the ICO, and while this narrow focus is effective it’s nevertheless a model that should be expanded more widely. These 4 regulators – together with the MHRA, the Civil Aviation Authority, the Vehicle Certification Agency and many other regulators at the frontier of AI and other technologies – would benefit from improved cooperation to accelerate understanding of new technologies and business models.

For example, generative AI that continuously improves and evolves is a poor fit for traditional regulatory processes, in multiple sectors, which focus on authorising discrete products and services at one point in time: contrast a static x-ray machine with a continuously iterating AI medical device. The MHRA, however, has already developed world-leading guidance on this issue for AI medical devices. It’s a framework that autonomous vehicle regulators are already exploring how to adapt, and other regulators may be similarly keen to adopt and fork it for their own use cases.

Exploring a cross-sectoral innovation regulator

Finally, as frontier, disruptive innovations also challenge legacy, sectoral regulator structures, entirely new regulatory models should be considered. Startups who cross multiple regimes still face high and often duplicative costs early on, while others fall through the cracks of existing regulatory perimeters.

Cross-sectoral sandboxes are one way to solve this, and the announcement of a new suite following the Vallance/McClean Review – including for AI, space, engineering biology and energy – are a positive sign of intent. But sandboxes have also historically faced challenges. Without i) stable funding, ii) a clear pathway for firms to full authorisation, and iii) sufficient freedoms within the sandbox environment for firms to gather evidence necessary to achieve other commercial, regulatory or fundraising milestones, sandboxes can simply become marginalised units within regulators that provide little durable value. This means some have failed altogether, while others (such as the FCA’s fintech sandbox) have struggled to sustain their impact or engender a more widespread, pro-innovation regulatory culture. At minimum, the government must beware the same drop-off in intensity repeating.

More ambitiously, however, the government should consider a new, permanent, cross-sectoral innovation regulator with an explicit mandate to support innovation. This would have a fundamentally different incentive structure and risk appetite compared to today’s sectoral regulators. It would prioritise innovation rather than marginalising it, as authorities that juggle multiple duties and objectives within a single narrow sector end up doing. As argued by John Fingleton (UKRI board member, Form adviser, and former Head of the predecessor to the CMA), this new entity could have a better risk appetite and incentive structure by operating akin to consolidated pension funds: risk appetite could be pooled from existing regulators, and the bigger its portfolio, the more it can afford to take risks.

Fortunately, there is a precedent here. Accelerate Estonia is a dedicated unit in the Estonian Ministry for Economic Affairs which exists to identify and enable scalable, novel technologies with significant economic potential that are held back by existing rules. As a central unit, they hold both the mandate over other departments to remove regulatory barriers and have the capacity to do the heavy lifting for them, with most projects completed in less than a year. This provides a blueprint for an institutional design which is proven to be effective, and one that the UK should build on quickly.

We’ll be continuing our work to fix the regulators and we’re always keen to hear from founders, investors and policy folk working in regulated markets. If you’re fundraising, have feedback about the report, or want to share an experience with a regulator, get in touch.